Deal flow slowed significantly in December, with deals done dropping to less than half of November’s total and falling below September’s numbers. This familiar year-end slowdown reflects the industry’s focus on existing commitments and preparing for the new year after the fall’s peaky deal-closing rush.

Of the book deals that closed in December, Fiction remained the most active category, with strong showings in International Rights and Children's Literature—particularly Picture Books and Middle-Grade and Young Adult Fiction and Audiobooks held steady across genres.

Debut authors faced a record-quiet month. Categories that traditionally perform well for debuts—general adult fiction, thrillers, and audiobooks—lagged in December, as publishers prioritized established authors and genres like memoirs, business, and narrative-driven projects. For debut authors, the holiday season remains a challenging time to secure deals, underscoring the importance of timing and strategy in navigating the publishing landscape.

Genre Activity

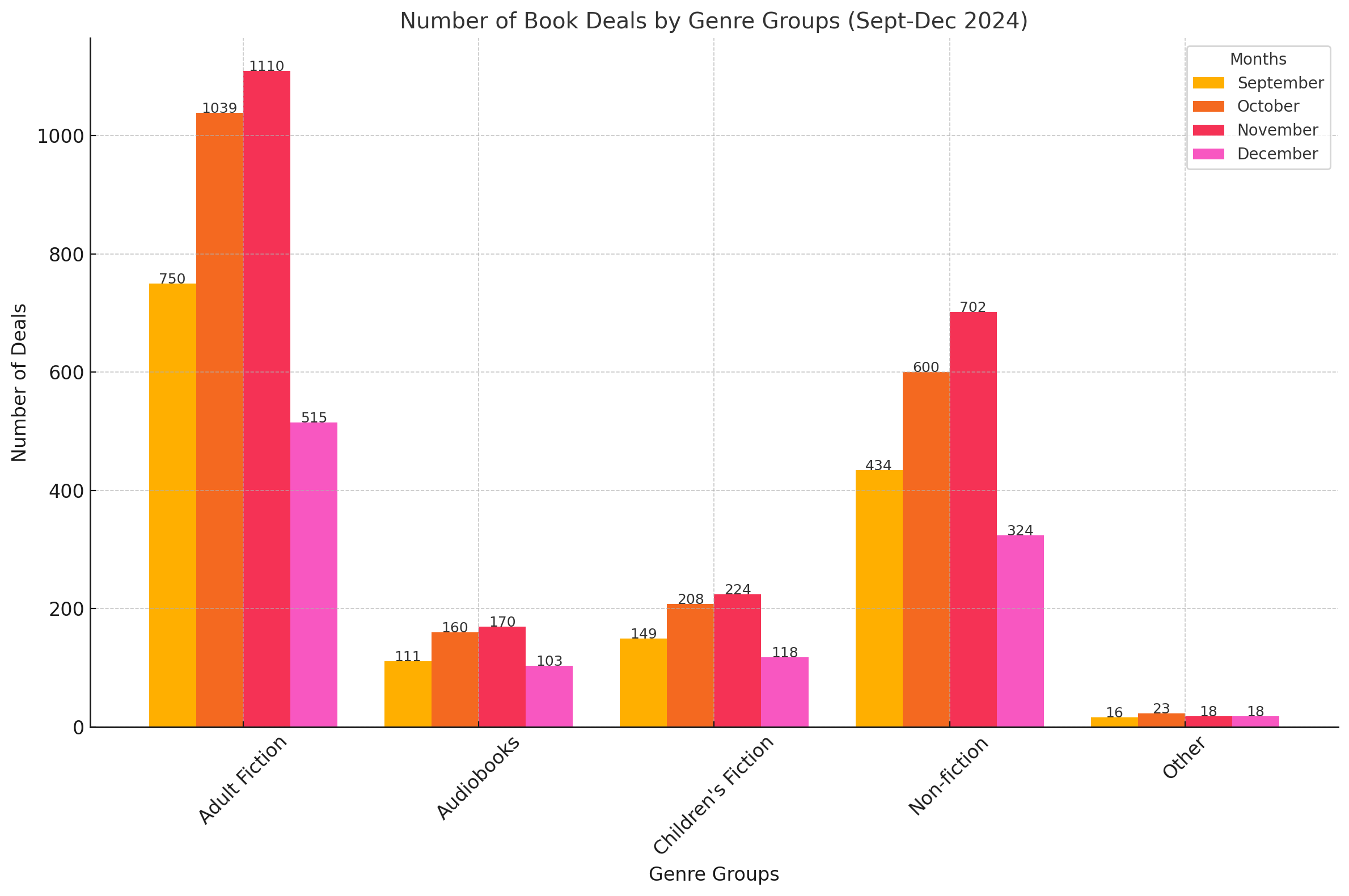

From November to December, audiobooks proved the most resilient, with December deals reaching 61% of November's volume. In contrast, overall deal volume in December was less than half of November’s. Children's fiction also held steady, with deals exceeding half of November’s volume, while adult fiction and non-fiction saw sharper declines, each dropping to 46% of November's numbers. This highlights the sustained growing momentum of audiobooks and the relative stability of children’s fiction, even as deal interest in other categories fluctuates.

Strong Global demand for Fiction: Fiction dominated December’s pipeline, with international rights deals leading the way, signaling continued global interest.

Sustained interest in Children’s Picture Books: A subset of Children’s Fiction, this is a smaller market overall, however children’s literature—especially picture books—performed well.

Audiobooks' continue their steady march: Audiobook deals showed strong activity, reflecting sustained consumer demand and resilience across genres.

Niche Genres saw limited interest: Paranormal fiction and specialized non-fiction categories like true crime and humor saw minimal deal-making.

Top Performing Genres

Fiction leads the pack: Fiction accounted for over a quarter of all deals, reflecting its dominant position in the market.

Non-Fiction remains steady: Around 14% of deals focused on non-fiction, with memoirs and business titles taking center stage.

Audiobooks are on the rise: Nearly 10% of deals were for audiobooks, cementing their status as a growth area across genres.

Children’s Literature maintains interest: Children’s books made up nearly 15% of deals, with picture books standing out as a key category.

Debut Authors face challenges: Debut fiction struggled, representing just 2% of deals, highlighting limited opportunities for new voices during this season.

Literary Fiction holds ground: Despite a competitive market, literary fiction retained a small but steady share of deals.

Low Performing Genres

Fewer deals overall in December, with a focus on more established authors and categories, may mean fringe manuscripts are often squeezed out during this time of year.

Romantasy and Paranormal and Inspirational Fiction all had minimal activity.

Non-Fiction Niches, like true crime, diet, and humor, experienced minimal traction.

Sparse Digital Rights Activity across categories like mystery, horror, and debut fiction.

Debut Authors

In December, debut authors accounted for just under 2% of total book deals, a slight uptick compared to November, but still low compared to the fall frenzy. Debut deals this past month highlighted distinctive, genre-specific themes, including:

Poetry Collections: Tackling bold and evocative topics.

Sapphic Romance and Speculative Fiction: Reflecting a growing market for diverse, inclusive narratives.

Editor and Journalist Backgrounds: Several debut authors leveraged prior literary or journalistic experience to secure deals.

Notably, no debut deals were recorded in General Adult Fiction, Thrillers, or Audiobooks—a surprising shift from consistent activity in these categories during prior months. This trend highlights the cyclical nature of the industry and underscores the importance of timing submissions to align with market priorities. Take note, my debut friends!

Notable Agencies

2 Seas Agency and SBR Media carried their momentum from November into December, closing over 30 deals between them. Their activity spanned multiple genres, international rights, audiobooks, and multi-book agreements, showcasing their versatility.

Agencies like the Schulman Agency found success focusing on Fiction and Non-Fiction rights. Other notable players included Jane Rotrosen Agency, which excelled in Fiction and series-focused acquisitions, and Watkins Publishing, which stood out in Non-Fiction and illustrated works.

Geographic Market Trends

Agencies leading deals with Asian and Australian markets did deals in Children's Literature, likely reflecting these regions' growing demand for family-oriented and educational content. Asia led December’s deal activity, likely driven by interest in adaptable genres like Fiction and Children's Literature. Publishers in Asia may be looking for content with broad cultural appeal. Australia was a close second, showing particular engagement in Children's Picture Books and Non-fiction.

Agencies with European connections tended to focus on Fiction and Non-fiction genres with multi-territory appeal. Europe demonstrated steady performance, focusing on Fiction and Non-fiction genres with strong sales potential across multiple European markets.